Printed in the Summer 2014 issue of Quest magazine.

Citation: Pentland, John. "Religion and Money" Quest 102. 3 (Summer 2014): pg. 96-99

To reflect on the relationship of religion to money, there is no better starting point than "to go beyond time." In returning to the origin of the question, we may find a grain of truth and thus turn towards the remedy for an otherwise intractable problem. Countless volumes have appeared about the church's attitude to war and sex, but very little has been written about money.

To reflect on the relationship of religion to money, there is no better starting point than "to go beyond time." In returning to the origin of the question, we may find a grain of truth and thus turn towards the remedy for an otherwise intractable problem. Countless volumes have appeared about the church's attitude to war and sex, but very little has been written about money.

In his book Magic, Money, and Myth, William Desmonde shows that in some ancient cultures money was used as a symbol to replace food in sacrificial communion rituals. Participation in the meal implied a bond of loyalty with other members of the group and also signified entering into a covenant with the deity. Each communicant received a particular portion of the sacrificial flesh corresponding to his standing in the community. When money of different denominations began to be used in place of the portions of food, the establishment of a contractual relationship between two individuals at first retained traces of the original bond of religious loyalty among participants in the same communion, with impersonal bargaining replacing the patriarchal redistribution of foods among the brotherhood.

In any case, there is good reason to suppose that money was originally a sacred device created by religious authority to facilitate the exchange of necessities in an expanding society. It was intended to be a means of recognizing that human beings have individual property rights and at the same time that no human being or family is self-sufficient. In support of this theory, the French esotericist René Guénon states that coins of the ancient Celts are covered with symbols taken from Druid doctrine, implying direct intervention of the Druid priests in the monetary system (Gunon, 133-34).

With the huge increase in world population and international trading, this original purpose of money for the individual as so often the real significance of religion itself has been eroded until today it is completely forgotten. From the economic point of view which prevails in the modern world, money has value almost exclusively on a material level. Both the smallest transactions and the largest, which are now carried out by bookkeepers without anything of intrinsic value changing hands, are more often done in a mood of impatience, irritation, and negativity than as an expression of loyalty in individual human relationships. No longer a reminder of higher values, money has become such a social convenience that it is even a social necessity.

Originally made of gold, silver, or copper of something that didn't spoil with time all but the smallest denominations of the coinage are now printed on otherwise worthless paper. The modern American nickel retains only a vestige of the original notion in the words "In God We Trust" now relegated to the rim, as the image of a president in the center reflects control of the monetary system by the temporal government.

The worldwide inflationary trend, which is considered a principal problem for today's social systems, may be seen as a further step in the progressive "debasement" of the currency. Inflation is thus the last inevitable result of control of the money system by temporal authorities and a symbol of the deterioration in the quality of individual human relationships.

The trend towards high interest rates is another sign of this deterioration. Interest-bearing loans"lending money out to usury"are still forbidden by the strictest religious authorities in the Middle East and were until recently forbidden throughout Islamic countries. The original basis for the rejection of usury was generally the primitive custom of economic assistance to one's fellows, in accordance with which the taking of usury among brothers was regarded as a serious breach against the communal obligation to provide help. The Old Testament is quite specific on this point: Take thou no usury of [thy brother] or increase: but fear thy God; that thy brother may live with thee. Thou shalt not give him thy money upon usury, nor lend him thy victuals for increase (Lev. 25:36-37). The fact that the prohibition against usury became increasingly severe in Christianity, under quite different conditions, was chiefly due to various other motives and factors. Only in the nineteenth century was the church obliged, under the pressure of certain unalterable facts, to remove the prohibition.

In the last millennium of Western history, religious hostility toward usury had little to do with individual human relationships but resulted instead from the attitude of Christian religious ethics toward the rational acquisitive enterprise as such. Every organization, and certainly every established religion, requires sources of material support. As money relationships became more and more depersonalized, the churches have tended to separate themselves from the commercial establishment, to suspect its motives, and to solve their material problems at arm's length from it. Even in religions which otherwise placed a high positive value on the possession of wealth, purely business enterprises became the objects of adverse judgment. Christian authorities down the centuries have repeatedly invoked the doctrine that Christ literally requires poverty of his followers, and a whole train of martyrs died for this principle, while the church itself became increasingly powerful in the material sense, due largely to the cheap and efficient labor of ascetic bachelors. Gradually the ethical standards demanded by the church hardened and kept the most devout groups far from a life of trade. A business career was adopted only by those who were lax.

This ever-widening gap between religion and the pursuit of money, the typical goal of the rational acquisitive enterprise, has become an accepted fact in most modern societies. The churches and the business class have come to confront each other as the two principal sources of scale and power (visibly obvious in so many towns and cities, where churches and banks are the most prominent architectural features). Each claims that the function of money is to fulfill the advancement of general human welfare but on different grounds. The churches claim that giving for the religious and the poor is a basic human need; the business people justify their acquisitiveness on grounds of its effectiveness in providing the masses with material support. Naturally, interdependence between the inner and outer aspects of life has led to many compromises and inconsistencies, since it is not possible to keep these two aspects altogether apart. But, generally speaking, attempts by churchmen, in a period of declining church power, to reconcile religious ethics with the growth of economic power have been directed towards reform of money flow and distribution on a politico-social level.

Given the sacred origin of money, solutions to the problem of religion and money on this level can never be found. A solution is achievable only through reinstating the individual's relationship to money within the whole scale of his spiritual studies and strivings, that is, through reeducating him to regard money transactions as a measure of his individual human relationships. For, like everything existing, money is a vital part of life on the planet and is worthy of respect, of course at its proper level. True religion views everything, including money, in relation to universal laws. In showing us our dependence on each other, money acts to remind us of these laws. The only thing wrong with money is our present view of it. This is what needs to be studied and understood.

Where to begin? It stands to reason that such a program of reeducation cannot begin with the masses, who, in the last analysis, are not concerned with human values except in terms of physical survival.

Nor can much be expected from the many studies of money that are being made on the psychological level, although these may serve as useful shocks to our customary unconscious attitudes towards accumulation and waste. For example, Freud noted that in the modern Western world, the language of people of different nationalities is a mirror of their typical attitude to money. Germans earn money, Italians find it, the French gain or win it, the English have it or possess it, Americans make it. Freud pointed out also a common tendency among the clergy of his time to look on money as dirty; you mustn't touch it. He detected here some similarity to their attitude to sexual relations and even hinted at a direct connection between the problems of money and sex.

A contemporary student of the psychology of money with experience as a banker, Michael Phillips, says: "The hardest thing to convince people of is a fact only the very rich know: the way to make money is to do exactly what you want to do and to do it exactly the way you want to do it.' In his book, The Seven Laws of Money, published on behalf of a money-giving community, Phillips throws fresh light on the useless greed and fears which often lie behind the accumulation of money and block its social function in the circulation of energy on the psychophysical level. He shows that freedom from the "money game' comes from being efficient at it. His seventh and last law states that "there are worlds without money which exist like a star to guide human beings, but the world we live in is a world in which everything is related to money and our lives would be different if we were willing to see this and not deny it. Phillips stops short of an inquiry into the universal or spiritual laws which can move individual human beings toward freedom in their inner lives, in harmony with the whole of the divine creation.

Such an inquiry, impossible at the democratic level and inadequate at the psychological level, must obviously be the task of a spiritual elite men and women of insight to be found mainly in the churches and religious orders but also in academic circles, among philosophers, educators, scholars of anthropology, and perhaps some businessmen. Even modest studies begun at this level can be of practical help in dispelling, on the one hand, the popular theory that religion requires that serious aspirants to a spiritual life should not handle money at all and the myth, at the other extreme, that there is widespread inefficiency and corruption in the way the churches collect and distribute their funds. Superficially, there is justification for both of these statements, and each requires careful and continuing examination for coherent and practical thinking about religion and money to emerge.

Like the founders of all the great religious traditions, Jesus was concerned chiefly with the individual's need to reopen his relationship with the Higher (God) and through him with all his fellow beings. His teaching in the Gospels does not provide much material about money. When he declared, Render unto Caesar the things that are Caesar's and unto God the things that are God (Matt. 22:21), he was speaking about the individual's relation to the state. In his mission, he conducted himself with a certain casualness toward money You received without payment, give without payment (Matt. 10:8)”moving from place to place, picking corn along the way, even on the Sabbath. There was no attempt to provide for material needs over an extended period of time: Do not store up for yourselves treasures on earth where moth and rust consume, . . . but store up for yourselves treasures in heaven (Matt. 6:19-20). His disciples were advised to venture forth with more faith than money, with the implication that God will provide for the faithful.

Jesus became more specific in the story of the young man who asked him what to do to inherit eternal life. After reciting some familiar commandments, he told him to sell everything he had and give it to the poor. When this was more than the man could take, Jesus turned to his disciples with the well-known words, "It is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God "(Matt. 19:24).

Evidently, riches of all kinds, including money, are a very serious barrier to spiritual growth. Almost all of his nearest disciples were drawn from the poor. But, from the mouth of Jesus himself, there is no prejudice against wealthy men. Rich men are mentioned among the close disciples of Jesus (and Buddha) and on occasion they played important roles; for example, Joseph of Arimathaea was needed to beg Jesus's body from Pilate for placing in the sepulcher. Judas Iscariot was the treasurer of Jesus's twelve apostles, and the spiritual teacher G.I. Gurdjieff has indicated that in this role Jesus had profound trust in him (Gurdjieff, All and Everything, 739, 741). Whether this is so or not, from the very beginning of the Christian tradition, Judas and his treasurer's role have been awkward elements in the Gospel story, placed at an increasing distance from the inner teaching. A supremely high degree of understanding is called for if money is to serve its original purpose of reminding human beings that no one individual is self-sufficient.

Money does not seem to have been a major concern in the life of the early Christian church. It did not have much, and questions about how to understand Christ's teaching and how to behave towards each other were the most important issues. An austere lifestyle was generally adopted and for St. Paul, as for Jesus himself, money was a means of expressing individual generosity: "God loves a cheerful giver (2 Cor. 9:7). But even in this first generation after Jesus left this planet, before the Christian religion had became established, there are statements by Paul, such as "greedy of filthy lucre" (1 Tim. 3:8) and "the love of money is the root of all evil" (1 Tim. 6:10), which indicate that funds were desperately needed to support believers who had come to Jerusalem to join the fellowship and that the transient value of money, as expressed by Jesus in his life and teaching, was being forgotten. Money had become a problem separated from the religious practice.

A study of the growth of the Christian church, from its first three centuries through the Middle Ages to the present day, is needed to show how this separation between the spiritual practice and the attitude towards money has increased and hardened. At first supported by voluntary gifts, demands for tithes and first fruits are added. Endowments and vacant benefices (of bishops) are sold, absolutions and dispensations are granted at a price, taxes are levied by the Vatican, church courts raise money by fines, fees, and the sale of icons, or by permits to view sacred relics. In other words, as money needs are faced, spiritual leaders are apt to lose sight of the primary purpose of their ministries. They exploit the religious conviction of their followers in order to support the institution. The institution, rather than being a means to a higher end, becomes an end in itself.

The Reformation was partly a culmination of protests against the church's abuses in financial matters. As a result, the sale of indulgences was abolished and the charges for adoration of relics were removed. But there is no doubt that the financial transactions of the Christian church were always one of its most vulnerable points and remain so today.

The same contrast between religious attitudes and the attitude of the commercial class can be observed in the history of other traditions. The God of Wealth in Chinese Taoism, who is universally respected by merchants, shows no ethical traits; he has become of a purely magical character. In India, the section of the commercial class which belongs to the Hindu religion, including all the banking groups, follows a form of erotically tinged worship of Krishna and Radha in which the sacred meal in honor of their savior has taken the form of a kind of elegant repast. Already in antiquity, Judaism was largely a religion of traders and financiers, and on the whole Jewish ethics support a more positive attitude to money than other traditions. But even if it is less marked, there is a definite separation between religion and money transactions in Judaism also.

At the same time, it is only fair to remark that the largest church organizations, at least in the Christian and Jewish traditions, have managed to preserve for two thousand years some basically human attitudes toward property and money which stand in marked contrast to the attitudes of their social counterpart ”national governments and charitable foundations. Many prominent laymen are uneasy about the privileged position and the wealth of the churches, particularly the Catholic Church, and have heard gossip about financial scandals, even touching the Vatican Bank. At the same time, these leaders of society, taking advantage of the tax laws, are responsible for the trend towards centralizing charitable giving, depersonalizing and dehumanizing it to the point that the giver often demands something material in return for his gift and the recipient takes it for granted.

They will be surprised to learn what an extraordinary degree of local autonomy still obtains in dispensing Roman Catholic funds for charitable purposes, in spite of the statistical benefits of central management. In fact, the Vatican takes no more than two or three percent of the offerings, and a major share of the responsibility for spending is passed down as far as the parishes. James Gollan, who brings this to light in Worldly Goods, a study of the wealth of the Roman Catholic Church, is mildly critical of the strangely passive investment policy of the archdiocese of New York under Cardinal Spellman and his lay financial advisors in the 1960s. We may ask, what does it mean to be active in managing church money, given that an American Catholic bishop is absolute owner (under canon law) of negotiable investments worth in some cases more than $1 billion? Probably Gollan is right that a more active policy should be pursued, but the risks in the religious sense are one thing, and another simply in the material sense. More study of the way this question is faced by the largest religious organizations is needed. A conservative policy may be the best, but not merely because the church is an enduring institution which should not take short-term market considerations into account, or out of fear aroused by a few weak but charismatic preachers who have allowed their message to degenerate into profitable businesses.

No doubt what all these studies will show is that whatever are the faults of modern money systems, and they are many, it is not in money itself but in our attitude to money transactions that the principal confusion exists. To be quite practical, the difference between money and all the other attachments of temptations we lose ourselves in is that in present-day Western life, even for a child, money is a part of everything. The child who overhears mother complaining about lack of money or father boasting about his latest deal may well be asking: If money isn't a raison tre, what is?" Without some guidance about the place of money within the good life, a child's attitudes toward money are bound to be conditioned at a very early age by the unconscious reactions of his parents and teachers at times of financial shock. Not understanding anything about the relationship of money and religion, a child will grow up at the best to participate passively in accepted social values without striving to reach the spiritual maturity which is his or her birthright.

Gurdjieff has addressed this question fully and humorously in "The Material Question" (Gurdjieff, Meetings, 247-303). Although money is for him "despicable and maleficent" and "this aspect of human striving in itself had never been of interest to me," he succeeded as a young man in amassing a small fortune in order to be free "not to think about financial matters any more." Gurdjieff's account, however, shows that in fact he had to continue to the very end of his life to take the initiative in getting money to support his teaching activities, "of course without resorting to any means which could one day give rise to remorse of conscience, making use of capacities in me formed thanks to correct education in my childhood."

In each normal child there is a sense of adventure, a willingness to take risks to get what is wanted the most. In a world where money is part of everything, young people need much help in interiorizing this sense of risk in order to take hold of a truly religious understanding of what goes on within them and around them. Without this help, and without this inner understanding, passive obedience”out of fear"to the rule learnt in Sunday school—not to steal, not to take what is not given'”is unlikely to stand up to the stresses and emotional pressures of life, particularly in a big city. Sooner or later the rule will break down, unless that life"”with its omnipresent money demands"is being lived in the light of a religious tradition. More and more, all over the world, responsible questions about money, such as how much does one actually need, how much is enough for a given purpose, are disappearing from view. Simply to get more money is becoming a force, the action of which no one can easily deny, however ineffective he may be as a moneymaker.

A superficial understanding of the place of money in a religious life, and of its relationship with religion through occasional and impersonal giving, is no longer much help. Without a long work on oneself, it is impossible in contemporary conditions to be generous and free in regard to the force of money. Only those who are truly free understand how to use it as part of the demand they make on others for payment and sacrifice. General demands made by the elders of a religious organization on their followers tend to increase their fear of each other and in the long run to distort the teaching which the leaders are supposed to transmit. To use the force of money intelligently is to become aware of its original function in uniting individual human beings in service to the Highest; thus it may be necessary nowadays for a student to engage voluntarily in business for himself or herself for a certain period or to be faced with raising a large sum of money from nothing in a limited time for some inescapable reason. In other words, it may be necessary to have mastered the money game before one can see with certainty that the power of money over the human mind is limited and that there are things money cannot buy.

Sources

Desmonde, William. Magic, Myth, and Money: The Origin of Money in Religious Ritual. Glencoe, Ill.: Free Press of Glencoe, 1962.

Guénon, René. The Reign of Quantity and the Signs of the Times. Translated by Lord Northbourne. London: Luzac, 1953.

Gollan, James. Worldly Goods. New York: Knopf, 1971.

Gurdjieff, G.I. All and Everything: Beelzebubâ's Tales to His Grandson. New York: Dutton, 1964.

---. Meetings with Remarkable Men. New York: Dutton, 1963.

Phillips, Michael. The Seven Laws of Money. New York: Random House, 1974.

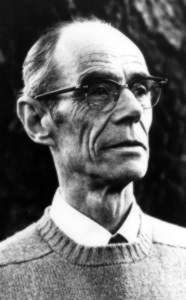

Lord John Pentland (1907-84) was president of the Gurdjieff Foundation of New York from its inception in 1953 until his death. He was instrumental in spreading the Gurdjieff Work in the U.S. During his lifetime, he was responsible for groups in New York City and many other parts of the country. If people are interested in reading more of his talks, there are others available for purchase on the Internet at lordjohnpentland.com. This article, which originally appeared in Gurdjieff International Review, is reprinted with the kind permission of Mary Rothenberg.